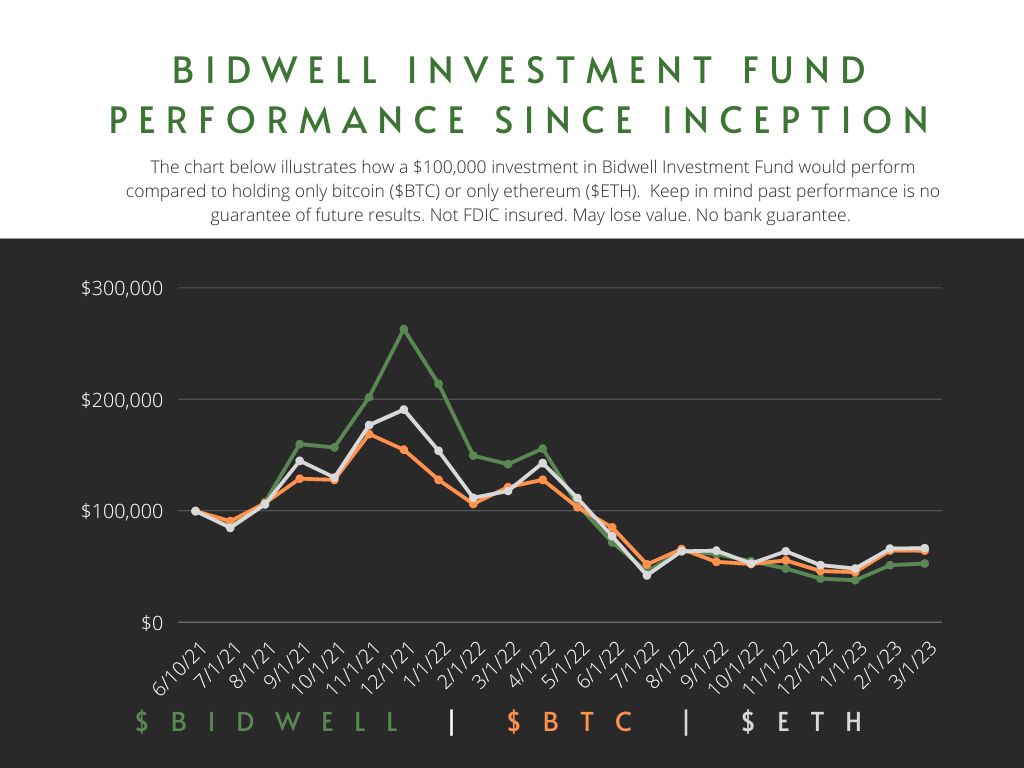

Since launching in 2021, Bidwell Investment Fund net return is -46% (updated as of 3/1/2023). By comparison bitcoin as an individually investment has returned -36% and ethereum as an individual investment has returned -34% over the same period of time. Please keep in mind past performance is no guarantee of future results.

Our mission at Bidwell Investment Group is to provide security and transparency to our investors and to guide them into making quality investment choices within the cryptocurrency space. We do so by buying quality projects, providing proper risk management, having a long term vision in our investments, educating our clients, and keeping a focus on global economic events and policies.

About Our Fund

View our Offering DocumentView our Offering Document- $50,000 minimum investment (we do accept bitcoin and/or ethereum as payment).

- We charge a 2% annual AUM fee + a 20% performance fee (the 20% performance fee is only taken out after investors have made back their initial investment).

- We do not have lock-up periods. Meaning clients maintain full liquidity of their investments at any time.

- We do not require any forced distributions – meaning clients can keep their gains on paper in perpetuity, if desire.

- Accredited investors & institutional clients only.

Features of investing with Bidwell Investment Group, LLC

Real time analytics of all holdings.

Clients can view their holdings anytime through our website that include:

– A list of all cryptocurrencies they are holding.

– The quantity of each holding.

– The current $USD value of each holding.

– The current % return of each holding as well as their entire portfolio overall.

Proper security of all assets.

As mentioned above, we cannot emphasize the importance of properly storing and securing cryptocurrency assets. We use a variety of security measures, including cold storage of crypto assets for our clients.

We also offer multi-sig signatures on wallets for our clients if they desire shared custodian access to their funds.

End of year tax liabilities.

Because our Fund is actively managed, we may incur end of year tax liabilities. We work with a professional CPA firm to provide end of year tax documentation. Having been invested in cryptocurrencies since 2013, we understand how to properly navigate crypto tax liabilities. In the event that the Fund has realized capital gains, we make a Q1 cash distribution to our clients to cover any tax liabilities that they would incur.

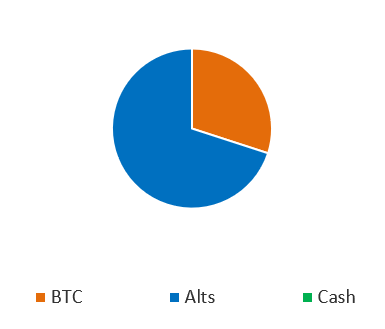

Bidwell Investment Group Allocation (as of 3/1/23, updated monthly)